Economical insurance coverage solutions are a priority for Lots of individuals right now, Particularly as the price of dwelling continues to increase. No matter if you’re looking for overall health, motor vehicle, dwelling, or existence insurance, discovering affordable solutions devoid of compromising on protection is vital. Permit’s dive into the whole world of economical insurance plan solutions and investigate how to make intelligent decisions On the subject of shielding yourself and also your family and friends. There's a chance you're asking yourself, how can you strike the proper stability involving Value and good quality? Allow’s break it down.

Once you’re on the hunt for inexpensive insurance coverage answers, among the list of first items to look at is your distinct demands. Are you currently searching for anything fundamental, or do you need much more considerable protection? Coverage insurance policies could vary widely in cost based upon whatever they include. For example, overall health insurance premiums can vary based upon your age, health and fitness issue, and the sort of coverage you require. By comprehension your preferences upfront, you can start narrowing down the choices that suit your finances.

A different crucial element to find inexpensive insurance plan alternatives is evaluating multiple vendors. You wouldn’t buy a auto without having examination-driving several versions, ideal? Similarly, when looking for insurance plan, it’s essential to get prices from diverse insurers. Insurance coverage corporations usually offer distinct rates, reductions, and Added benefits, so comparing them side by facet can assist you locate the finest offer. Bear in mind, Because 1 insurance provider is supplying a cheaper price doesn’t indicate it’s the ideal worth—search for guidelines that provde the most bang for your personal buck.

The Ultimate Guide To Innovative Insurance Solutions

Have you ever at any time read the phrase “you receive Anything you pay for”? In terms of insurance policies, that’s one thing to bear in mind. It might be tempting to choose The most affordable possibility accessible, but if it leaves gaps in the coverage, you could possibly be setting on your own up for financial hardship in the future. Cost-effective insurance policies answers are about much more than just lower rates—they must offer you extensive protection in case of emergencies. Often study the good print to make sure you're not sacrificing high-quality for value.

Have you ever at any time read the phrase “you receive Anything you pay for”? In terms of insurance policies, that’s one thing to bear in mind. It might be tempting to choose The most affordable possibility accessible, but if it leaves gaps in the coverage, you could possibly be setting on your own up for financial hardship in the future. Cost-effective insurance policies answers are about much more than just lower rates—they must offer you extensive protection in case of emergencies. Often study the good print to make sure you're not sacrificing high-quality for value.For those who’re in search of inexpensive motor vehicle insurance coverage, you may be amazed by the number of discount rates obtainable. Quite a few insurers provide discounts for things such as currently being a secure driver, bundling a number of insurance policies, or using a vehicle with selected security features. Prior to paying for a plan, Test if any savings utilize to you. These discounts can include up eventually, making your premiums more workable. With a lot of options around, acquiring very affordable insurance policy methods for your vehicle doesn’t have to be a headache.

What about health coverage? It’s one of the most essential types of protection, however it’s generally the most costly. However, there are methods to seek out very affordable wellness insurance policy answers. A person option is always to discover authorities-backed courses like Medicaid or even the Economical Treatment Act (ACA) Market, which supply subsidies determined by revenue. Even when you don’t qualify for these systems, lots of private insurers have finances-pleasant programs with minimal premiums and substantial deductibles. These designs could possibly be an incredible option in the event you’re frequently healthier and don’t expect to need many healthcare care.

A different tip for finding economical insurance policies methods will be to improve your deductible. The deductible is the quantity you pay back outside of pocket just before your coverage protection kicks in. By opting for a greater deductible, you may decreased your every month premiums. Certainly, you’ll want to make certain that you have got plenty of cost savings set aside to cover the higher deductible if wanted. This technique can do the job specifically perfectly for those who are cozy with some possibility and don’t anticipate Recurrent promises.

When trying to find reasonably priced coverage remedies, consider your Way of living And exactly how it impacts your premiums. For instance, in case you’re a non-smoker, you can fork out much less for life or overall health insurance. Similarly, your own home insurance coverage rates could be decreased if you reside in a safe neighborhood with low criminal offense fees or have security features like a residence alarm procedure. To paraphrase, taking techniques to lessen possibility can assist lower your rates. It’s all about displaying insurers which you’re Click for info a low-possibility policyholder.

Allow’s take a look at lifetime insurance for a minute. Many individuals postpone purchasing daily life insurance policy because they Assume it’s too high-priced, but there are affordable options offered. Phrase lifestyle coverage, By way of example, could be noticeably much less expensive than full everyday living coverage. With phrase everyday living insurance policy, you’re coated for a specific time period—say, 20 or thirty many years—as an alternative to on your entire daily life. If the Major problem is supplying for All your family members while in the event of the untimely Dying, time period everyday living might be An See all details inexpensive Option that gives you peace of mind.

Homeowners insurance plan is an additional region wherever affordability matters. You’ve labored not easy to obtain your own home, and protecting it is actually crucial. On the other hand, house coverage rates is often large, especially if your home is found in the catastrophe-susceptible area. One method to reduced your rates will be to enhance your property’s stability by introducing attributes like smoke detectors, burglar alarms, or fire-resistant materials. Insurers could reward you with decrease premiums if you take these safeguards. Identical to with other kinds of coverage, being proactive in reducing hazard can lead to much more very affordable rates.

How Insurance Recovery Solutions can Save You Time, Stress, and Money.

One particular miscalculation Many of us make when buying reasonably priced insurance policies solutions is failing to evaluate their protection demands on a regular basis. Eventually, your preferences might adjust, and what was after an enough plan may possibly now not present the security you'll need. One example is, should you’ve compensated off your car or dwelling mortgage, you might be equipped to lower your coverage and lower your rates. It’s constantly a smart idea to overview your procedures each and every year and make changes as essential to maintain your coverage reasonably priced with no sacrificing protection.In the world of very affordable coverage solutions, customer care must also Participate in an important position with your choice-making system. It’s not nearly locating the cheapest price—it’s also regarding how the insurance provider handles promises, solutions queries, and supports you after you want it most. Research critiques and ratings of likely insurers to obtain an plan in their name. A terrific insurance policies policy is worthless if the company providing it truly is challenging to get the job done with for the duration of annoying predicaments.

3 Easy Facts About Risk Reduction Insurance Solutions Explained

There’s also the choice of bundling your coverage procedures to save money. Quite a few insurers offer discount rates if you purchase a number of kinds of coverage with them. As an illustration, you could receive a split on your automobile insurance coverage premiums if You furthermore mght obtain your private home or renters insurance within the exact same supplier. Bundling is a wonderful method for anyone looking for economical insurance coverage options, because it helps you to simplify your coverage and spend less in the procedure.

Have you ever deemed the benefits of going with a superior-deductible wellbeing prepare? These ideas often have lower premiums and they are a very good fit for many who don’t foresee needing Recurrent healthcare treatment. By selecting a large-deductible prepare, It can save you on rates and place The cash you might have invested into a health See what’s new and fitness personal savings account (HSA). This could certainly help cover out-of-pocket costs whenever you do want health-related treatment, all when trying to keep your insurance policy reasonably priced In the long term.

How about renters coverage? Although not generally essential, renters insurance is An inexpensive way to shield your possessions in case of theft, fire, or other disasters. The expense of renters insurance policies is usually much lower than property insurance coverage, and it can present you with relief understanding that your possessions are coated. For all those residing in apartments or rental residences, that is a ought to-have insurance plan Option that doesn’t break the lender.

Yet another way to keep the rates reduced is to maintain a fantastic credit rating score. Quite a few insurers use credit scores like a Consider determining rates, and those with bigger scores are frequently rewarded with decreased charges. This means that by maintaining a tally of your credit score and improving upon it as time passes, you'll be able to obtain additional very affordable coverage alternatives. When you’re Uncertain of your respective credit history score, it’s truly worth examining and using methods to further improve it just before purchasing for insurance.

In summary, locating reasonably priced coverage answers doesn’t need to be a daunting task. By taking the time to understand your requirements, comparing options, and creating clever selections regarding your coverage, you can safe the defense you will need at a value that fits your price range. No matter whether it’s motor vehicle, wellbeing, life, or household insurance policies, there are lots of reasonably priced alternatives to choose from. All it will require is some research, versatility, and an eye fixed for reductions. So why hold out? Start Discovering your affordable insurance answers right now and acquire the coverage you should have.

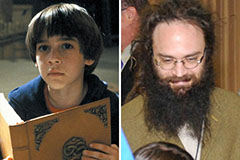

Barret Oliver Then & Now!

Barret Oliver Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!